The widespread adoption of renewable energy resources into the worldwide electric power grid has drastically increased the complexity and risks involved in the daily operations of market participants. In previous decades, traditional generators simply throttled up when demand rose and backed down (or went offline) when demand declined.

As markets evolved to more deregulation, many regions established a Real-Time (RT) Market (which uses rapidly changing prices to incent generators to increase or decrease output) and a Day-Ahead (DA) Market (a financially binding auction that enables purchasers to hedge against Real-Time volatility). For the majority of any given year, DA prices are higher than RT prices because buyers are willing to pay for the security of a hedge. During parts of the year, such as high summer or in the depths of winter, electricity demand is very strong, so RT prices can be extremely high and volatile, which is the risk buyers are mitigating.

We previously discussed on the PCI blog how Demand Response (DR) and Distributed Energy Resources (DERs) could be used to help manage this DA/RT risk. However, this blog post will focus on a few techniques for optimizing the revenue of intermittent energy resources (wind and solar) across these two markets.

What is a “price taker?”

Power producers like selling into the Day-Ahead Market (DAM) because it captures reliable, although generally modest, profits during most of the year. But they accept risk in doing so — a sale in DA becomes an RT obligation, and if the physical energy cannot be provided in Real-Time, the Seller must repurchase the power at the prevailing RT price. This can be costly if this happens to be one of the days with strong demand or weak supply.

One of the chief drawbacks of renewable energy, such as wind and solar, is the intermittent nature of the resource. While there are good forecasting methods for both these resources, they’re not always 100% correct. This uncertainty elicits risks when introducing energy from these resources into the market. How should this be managed in the complex DA/RT environment?

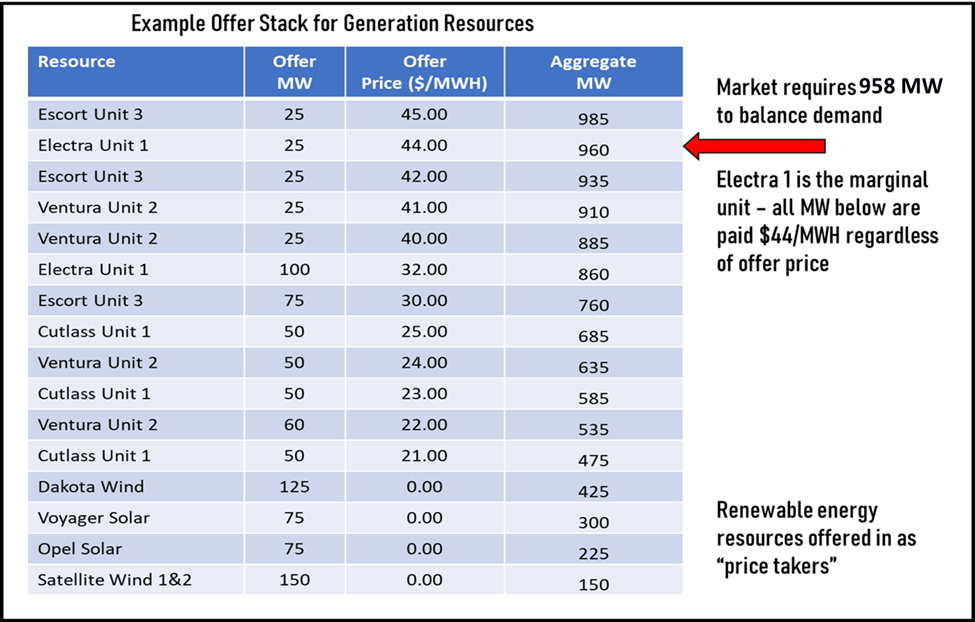

The safest approach for offering these resources into the wholesale market is simply to be a “price taker.” This means the unit is offered at a very low price, zero or even negative $/megawatt-hours. During each RT interval (five minutes or 15 minutes, depending on the region), the market’s dispatch engine will combine this offer with all the other resources and sort it from low to high. It compares this “dispatch stack” to the load expectation to set a market clearing price (MCP). This is discussed in one of my previous posts, “How Locational Marginal Pricing Markets Work.”

Since most power units in the dispatch stack offer their units at a non-zero price (usually their marginal cost), then units offered at zero price will always be dispatched. : The wind or solar unit will produce as much power as possible based on how fast the wind is blowing or how bright the sun is shining, but it will be paid whatever price is set by the market.

This process is safe for the resource because at no time is the unit obligated to produce any more energy than it’s capable of. The downside is that RT prices can be lower than DA prices for large parts of the year. As a result, the resource will forgo potential higher revenue in the DA to avoid risk in RT.

What tools and resources are needed for optimization?

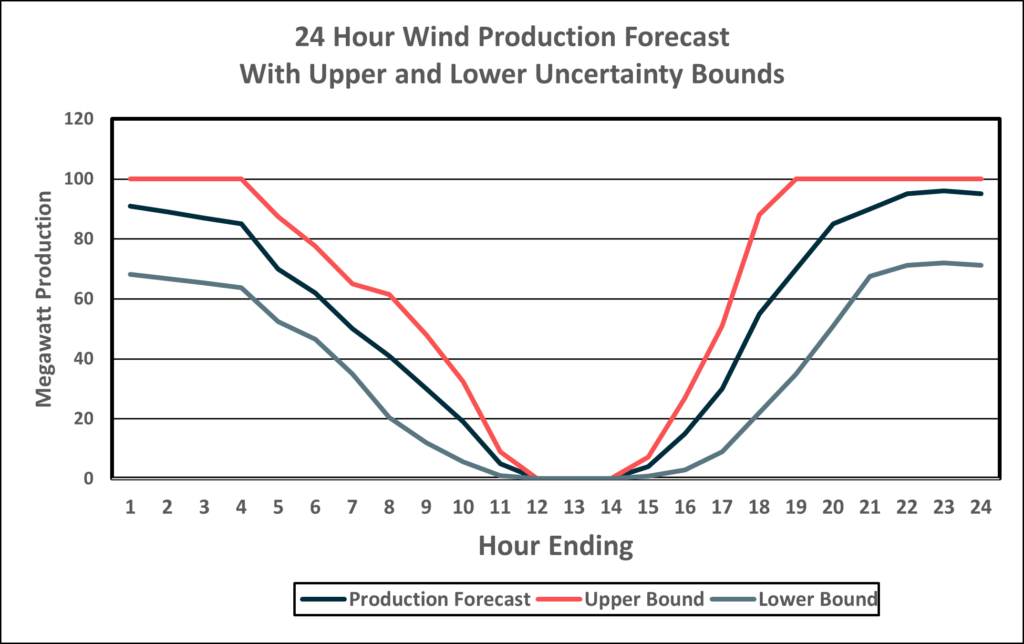

Production Forecasts. Much work has been done to quantify the uncertainty of various wind and solar forecasts. The wind profile and solar irradiance have been studied at these facilities’ locations, some for years prior to construction. From this, annual production estimates are calculated, from which flow financial analyses that inform pricing and contract terms.

Daily weather forecasts are used to produce pinpoint production forecasts for wind and solar resources. These forecasts are compared to actual performance, and statistical analysis can reveal the average accuracy of forecasts, and improvements are made to the forecast algorithms. These forecasts are made available by data service providers to utility companies, wind and solar farm owners and operators, and to Independent System Operators (ISOs) for planning purposes.

Price Forecasts. Having an accurate production forecast is only half the challenge when optimizing these resources across DA and RT. The second critical input is a price forecast. Just like the production forecasts, there are data service providers that use very sophisticated models to analyze trends in customer load, weather, fossil fuel prices, transmission system congestion, and a myriad of other parameters to develop short-term and long-term wholesale power price forecasts.

Analytical Tools and Expertise. To accomplish the optimization of these wind and solar generation assets, an investment will be needed in analysis tools and personnel resources. The analysis team will need access to both the forecasts described above, but also production data and market price data to fine-tune the process. Finally, business processes in the Day-Ahead and Real-Time desk environment will be needed to manage the daily operations, check for errors, and make improvements.

What questions should you ask each day?

The optimization to be performed is basically how much of production should be offered in DA to capture the price premium versus how much to leave to RT and be a price taker. You should address the following questions:

Q: How volatile are Real-Time prices expected to be on the operating day?

This is a judgment based on the RT price forecast, seasonal weather expectations, daily prevailing weather forecast, and even the past few days of history. If the market is expected to be very calm – that is, no high demand or scarcity of supply, then there is less risk of a Real-Time “price blowout” and less risk that exposure to RT will result in high costs.

If the market expects supply scarcity in Real-Time, spikes in demand, transmission congestion issues, or even unpredictable wind patterns or solar performance, then there’s a higher risk of costly RT exposure.

Making a judgment related to RT volatility affects the DA offer strategy for the unit. If RT is expected to be calm, it may be worth offering more production in Day-Ahead, collecting the DA premium, but accepting the risk of non-performance and RT exposure, and vice versa.

Q: What is the accuracy of the production forecast?

If, for example, a forecast in a given season has a confidence band of 20% accurate on average, this means the production could be 10% higher or 10% lower than the forecast at any hour. More importantly, is this accuracy dependent upon the time of day? For example, a solar forecast may have more inaccuracy in the mornings and evenings when there may be fog or cloud cover but very good accuracy at midday when these conditions aren’t present. Similarly, some locations have wind patterns that rise late in the evening but drop off at daybreak. The accuracy could be very good at midnight but poor during daylight hours.

What’s the approach?

If an organization wants to move from using an RT price-taker strategy to capturing more DA revenue, it can take a stepwise approach.

Step 1. Small offer in DA on low-risk days. When the RT market is not expected to be volatile, a small portion of the production forecast could be offered in DA. For example, 10% of the forecasted production is offered in the DA. However, there are any hours with limited production forecasted (morning and evening for solar or during low wind hours). During these hours, no production is offered in DA. This removes the risk of non-performance during these hours, which could lead to an RT exposure.

Step 2. Larger offer in DA on low-risk days. Once comfortable with the concepts and practices of DA offerings, more and more of the wind or solar forecast could be offered in DA on low-risk days. This will capture more of the DA premium yet limit exposure to RT price uncertainty.

Step 3. Plan for high-risk days. DA strategy for days where RT prices are expected to be volatile could go one of several paths:

- Offer nothing in DA. This certainly protects against RT exposure and, in fact, maybe the most lucrative approach – the resources earn high RT revenues. However, other market participants may also see the RT volatility coming and bypass the DAM. This could lead to high DA prices due to a lack of supply but with buyers wanting to hedge against RT. If the high RT prices don’t materialize, you could miss an opportunity.

- Offer something small in DA. Offering some of the production in DA, especially during peak hours, could be a good approach to capturing both DA and RT revenue. The caution is not to offer more production than can be reliably counted on. That way, if production falls short, you avoid RT exposure. This is where forecast accuracy is important. If a facility is forecasted to produce at 10% of its nameplate capacity in a certain hour, and its forecast accuracy is 20%, then there’s an equal chance the facility will produce at 20% of capacity and at 0% of capacity. This hour’s production should go to RT.

- Separate strategies for wind and solar. In many regions, the wind patterns will be well understood and predictable, so effective optimization strategies can be tailored to the prevailing trends. Similarly, solar forecasting is usually very accurate in the heat of summer (precisely because it’s summer!) An optimal DA/RT strategy for solar would therefore look quite different from an equally optimal wind strategy. In fact, the wind strategies will be different for each resource if they are geographically separated.

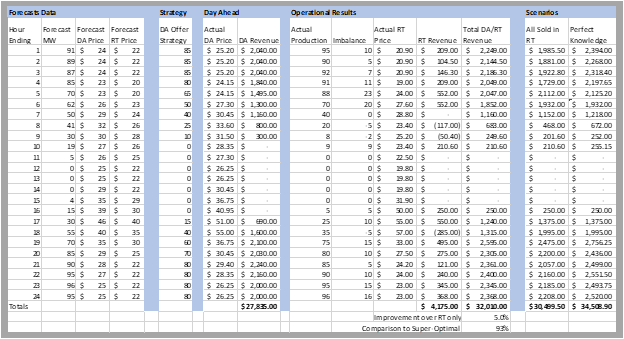

Step 4. Analyze and report. The optimization team must be able to calculate the effectiveness of each strategy in RT in order to inform the next day’s plan. Production information should be automatically downloaded and lined up with forecast production, forecast prices, and actual prices, both DA and RT. You can construct three benchmarks:

- Actual revenue. How much revenue was actually captured by the strategy?

- RT sales only. How much revenue would have been earned if the entire actual output had been sold in RT (price taker strategy)?

- Super-optimal. How much revenue would have been earned if perfect pricing and production knowledge had been available? That is, the entire production was sold by the hour in whichever market had a higher price for that hour.

As shown in this example table, the DA strategy increased revenue by 5%, with minimal hours of negative RT imbalance. Further, the revenue generated was 93% of what could have been acquired with perfect knowledge of exact production and perfect forecasting of prices in both markets.

Once the operations team integrates the results of the strategies into its daily operations and planning, along with comparing results with the benchmarks, the individual DA strategies can be fine-tuned by the hour, by resource, and by market.

Reaching long-term success

Using a disciplined, stepwise approach, market participants with solar or wind resources can realize revenue improvements by optimizing the output of these facilities across the DA and RT markets. Reliable price and production forecasts are crucial. Improvements in revenue from these sources can more than offset the investment in resources and tools. Commitment to a stepwise approach, consistent evaluation, and thoughtful adjustments are necessary for long-term success.

Robust analytical tools such as PCI GenTrader Portfolio Optimization Software are also helpful in developing an effective market operations approach. Contact us to learn more.